The U.S. Commerce Department on Monday finalized a new rule to impose

anti-subsidy duties on products from countries that it has determined

undervalue their currencies against the dollar, including potentially China.

The move could provide a fresh irritant in U.S.-China trade talks just weeks

after the world’s two largest economies signed a Phase 1 trade agreement and

comes a day after Beijing accused Washington of spreading fear about the

fast-spreading coronavirus that originated in China.

In theory, the new rule would allow the

Commerce Department to impose duties on China, even though the U.S. Treasury

Department recently removed its designation of China as a currency manipulator

as part of the Phase 1 trade deal.

Commerce said it would generally rely on the

Treasury’s expertise in determining undervaluation, but the two processes could

come to different conclusions since they resulted from different statutes. The

draft rule was first published in May. It said it would only impose

countervailing duties on imports of specific products that both benefit from

countervailable subsidies and are found by the U.S. International Trade

Commission to injure U.S. industries. The rule would not result in the

application of such duties to all imports from a given country, because not all

such imports injure U.S. industries, it said. Commerce said the new rule was a

measured response to longstanding, bipartisan calls to use existing laws to

address unfair foreign currency practices, and was part of a broad push by the Trump

administration to crack down on trade imbalances. “The Trump Administration is

doing the right thing by confronting the problem head-on,” it said in a

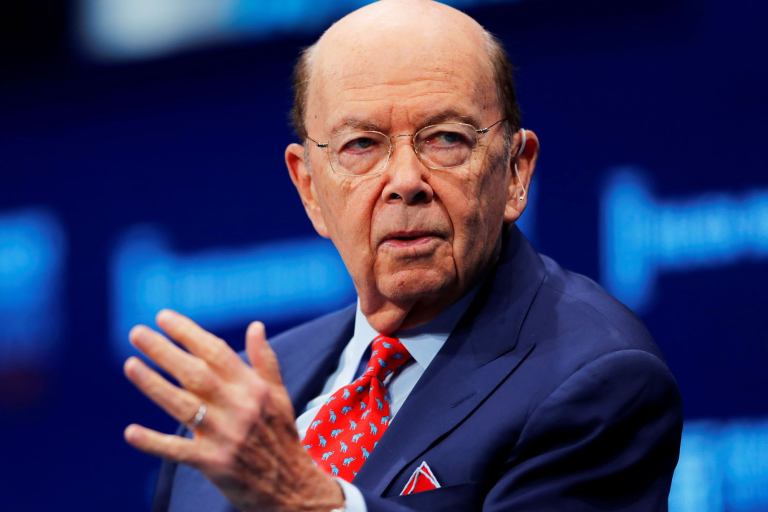

statement. U.S. Commerce Secretary Wilbur Ross said the new rule marked another

important step intended to “level the playing field for American businesses and

workers.”

Mark Sobel, a former senior U.S. Treasury official, and adviser

to the London-based OMFIF economy policy think tank, said the new rule failed

to address many of the concerns raised after the draft rules were published in

May, and would likely be inconsistent with World Trade Organization rules.

“There is no precise way to measure currency undervaluation,” he said, adding

that Commerce had no responsibility or expertise in international monetary and

currency matters. “This is a unilateral policy that will alienate countries

around the world.” The Commerce Department said it would not normally include

monetary and related credit policy in determining whether a government had

acted to reduce the exchange rate of its currency to bolster its domestic

industry. In addition to China, the new rule also could put goods from other

countries at risk of higher tariffs, including Germany, Ireland, Italy, Japan,

Malaysia, Singapore, South Korea, Vietnam, and Switzerland. Those countries

were all on the “monitoring list” included in the Treasury Department’s

semi-annual currency report, which tracks currency market interventions, high

global current account surpluses, and high bilateral trade surpluses. The

department said its proposed rule would amend the normal countervailing duty

process to include new criteria for currency undervaluation, including a

finding of government action on the country’s exchange rate.

Reuters